Let’s face it. Many of us have a hard time keeping track of our finances, especially when money is tight. A whopping 70% of Americans are now living paycheck to paycheck. In fact, 57% of Americans say that they have less than $1000 in savings, ultimately putting their retirement and future in jeopardy. To add insult to massive amounts of injury, 34 percent of Americans have zero money saved. How can this be when America is one of the wealthiest nations in the world? Today, I’m going to be going over the top five ways that you can save money so that you can ultimately create financial wealth and prosperity for you and your family. Let’s get started!

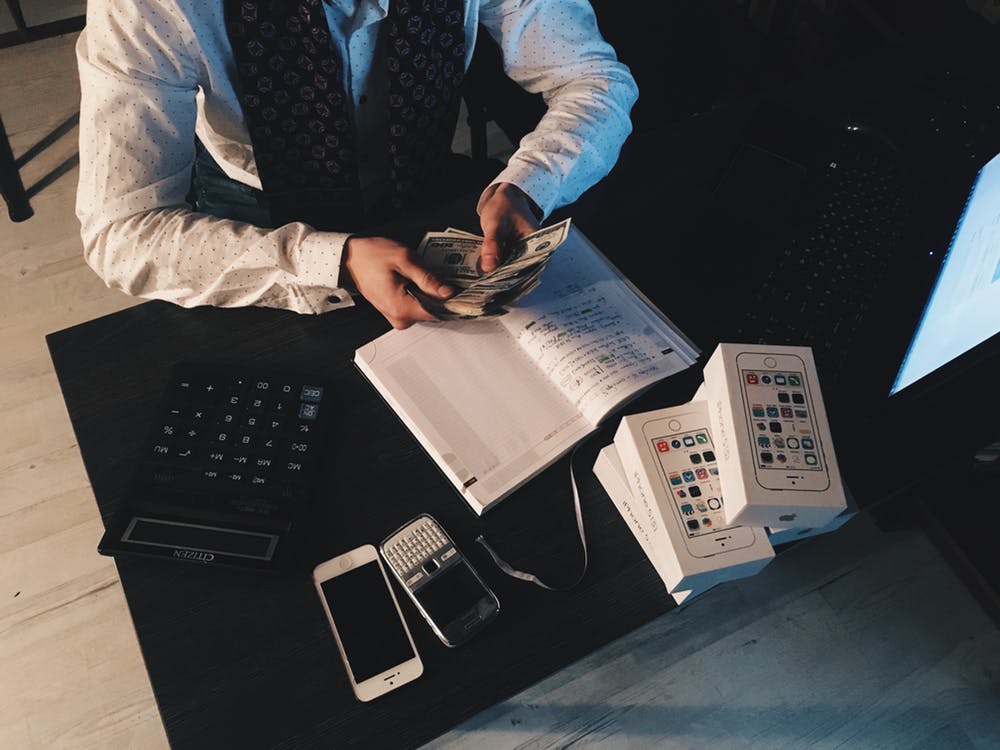

1. Create a budget

Having a budget is necessary if you want to have any financial success whatsoever. At the beginning of the month, create a written budget that is unique to that month. List all of your expenses and the amount of money you’re going to allocate toward those expenses. Once your budget is set, the biggest challenge next comes from the discipline of not wanting to break the budget. Every dollar has a name and knows where it’s going. Overall, creating a budget is arguably the most important step towards reaching financial freedom.

2. Add savings into your budget

Every month, you should be saving at least 10 percent to 15 percent of your income. If you aren’t able to put that amount of money into savings each month, chances are your expenses are too high or you’re just not making enough money. If it’s expenses, cut back on desires such as entertainment. If it’s income, pick up another job or create something that provides extra cash flow every month. By saving early, you’ll be in better shape than the majority of society when it comes to retirement and you will have saved more money for traveling.

3. Know what you’re saving for

When a lot of people think of saving money, they think of saving to save. However, this is not what you want to do! The average rate of inflation per year is around 2%. This inflation rate will eat away at your money over the years. Instead of saving to save, it’s better to save to invest. Invest this money into safe investments that will grow over time like treasury bonds and good growth stock mutual funds. The S&P 500 is setting record highs as it has grown over 20% in the last year. Adjusted for inflation, you would’ve made 18% on your money. Also, save for an emergency fund of $1,000 as well. If you need a title loan, Starfish Lending has you covered. All in all, save for safe investments.

4. Don’t buy a new car

Buying a new car is a very poor financial decision in general, let alone if your don’t have any money for one. Instead, buy one for cash that’s within your budget. Your new car will depreciate nearly 20% within the first year of ownership. If you buy a pre-owned one with cash, it will ultimately cost less and allow you to invest your extra money.

5. Watch the credit cards

This step is pretty straightforward. Only use credit cards if you know you’ll be able to pay them off at the end of the month. You can utilize the points many credit cards offer, allowing you to save money on both accommodation and airfare.